Trafigura warns the world is running low on copper

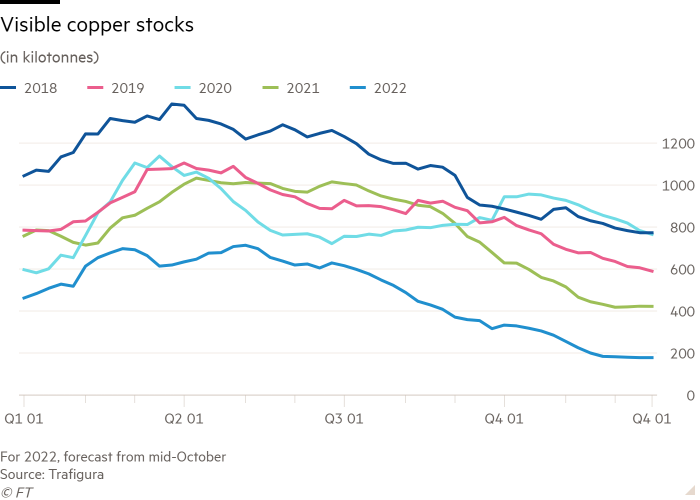

Global copper stocks have fallen to perilously low levels, one of the world’s largest commodity traders Trafigura has warned.

Speaking at the FT Mining Summit on Thursday, Kostas Bintas, co-head of metals and minerals trading at Trafigura, said the copper market is today running with inventories that cover 4.9 days of global consumption and is expected to finish this year at 2.7 days, according to its own forecasts. Copper stocks are usually counted in weeks.

The price of copper, used in everything from wind turbines, electric wires to electric vehicles, is now trading around $7,400 a tonne, some 30 per cent lower compared to early March, when it was trading above a record $10,000 a tonne.

Limited inventories raise the risk of a sudden spike in prices should there be large drawdowns and a dash among traders to secure supplies.

While the strong dollar and global recession fears have weighed on copper prices in recent months, executives in the global metals industry argued on Thursday that limited supply in the market remained supportive of prices.

“While there is so much attention being paid to the weakness in the real estate sector in China, quietly, the demand for infrastructure, electric vehicle-related copper demand, more than makes up for it,” Bintas said. “It actually not only cancels completely the real estate weakness, but also adds to their consumption growth increase.”

He added that the situation was no different in Europe, with the region accelerating its transition into renewables as it tries to wean itself off Russian gas, leading to copper demand increase.

“It is not accidental that the EU has decided to bring forward the target of doubling its solar capacity from 2030 to 2025. All that requires a lot of copper,” he said. “Look at electric vehicles everywhere, [the numbers on the road] are surprising to the upside. That’s a lot of copper too. As a result, we’ve been drawing down stocks throughout this very difficult year.”

However, some copper bears believe the slowdown in China’s property market — where the metal is used in wiring, plumbing and facades — and the energy crisis in Europe will weigh on demand.

Marcus Garvey, head of commodities strategy at Macquarie, said the copper market is set to head into a surplus of 600,000 tonnes next year as supply grows from Latin America and elsewhere. “All industrial metals will move into surplus next year,” he said, citing the impact of the global macroeconomic downturn.

This week stocks of copper in London Metal Exchange warehouses have fallen sharply. Analysts at Peel Hunt said “traders in China are scrambling to secure metal as Shanghai stocks have fallen recently and traders are grabbing what they can”.

Inventories of copper in warehouses run by exchanges such as the LME do not provide a full picture of copper stocks in the supply chain, since many industrial users will hold their own reserves of metal.

But visible stocks can have a large influence on sentiment in the market.

“We certainly have no problem selling copper,” Freeport chief executive Richard Adkerson told investors on a conference call, Reuters reported. “It’s just striking how negative the financial markets are about this industry and yet the physical market is so tight.”

Jonathan Price, chief executive of Canadian copper miner Teck Resources, said the “macro view is very disconnected from the underlying physical fundamentals of the copper market”.

Bintas, who last year had predicted copper prices would reach $15,000 a tonne, said copper was being sold on recession fears, but he expects to see “very quickly” a “structural repricing” once those fears subside.

Considering the copper shortage that is happening now, “I think it’s fair to assume a higher price of what we have today,” he said. “Is it going to be more than $15,000? I think time will tell.”