How bonds ate the entire financial system

It was a crisp September day in 2015 when Timothy Young arrived at Houten, an unremarkable Dutch commuter town, determined to collect an almost 400-year-old debt. He carried a case containing a fragile piece of goatskin covered in dense writing and numbers. It was a bond, issued in 1648 by a group of Dutch landowners, who managed the dikes on a stretch of the river Lek. They had borrowed 1,000 guilders from a local merchant and the bond explained that, in return for the loan, the merchant would receive a 5 per cent interest payment every year — for ever.

Although the terms of this so-called “perpetual” bond have changed over centuries of wars, depressions, revolutions and new currencies, it is still a valid liability of Stichtse Rijnlanden, a Dutch utility, and is now owned by Yale University’s Beinecke Library. Young, a curator at Yale, was collecting €136 of interest from a delighted Dutch official, who had made a giant cheque to commemorate the payment.

For Young, the biggest thrill was being taken to visit the dike the bond had financed in the 17th century. “For a nerd like me, that was just fabulous,” Young says. “It’s a tiny thing, but that’s the takeaway curators look for: what is this object, why was it made, how did it survive the ages, what does it mean today and how can we connect all those things to understand human nature a little better?”

Bonds have long been considered the most boring bit of finance. They occasionally crop up in literature, almost always as a signifier of dreariness. The Great Gatsby’s narrator Nick Carraway was a bond salesman and Sherman McCoy in Tom Wolfe’s The Bonfire of the Vanities traded them. Bonds have never figured in the popular imagination in the same way as stocks, say, or corporate M&A. There has never been a “meme bond”. Ian Fleming chose the name Bond for his spy because he thought it was “the dullest name I’ve ever heard”.

Even so, they have played an integral role in the development of human society, from subsistence farming to the modern era, funding everything from wars and railways to Tesla’s electric cars and Netflix. “The bond market is the most important market in the world,” says Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater. “It is the backbone of all other markets.”

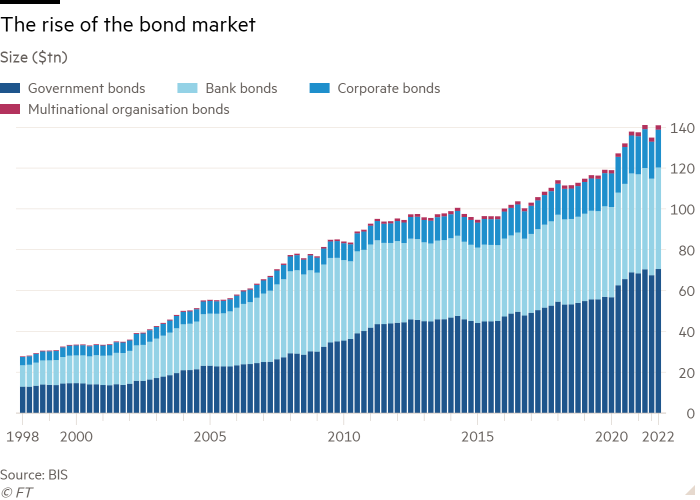

While the bond market has become larger and more powerful, the importance of banks — historically the workhorses of the capitalist system — is subtly fading. The global bond market was worth about $141tn at the end of 2022. That is, for now, smaller than the $183tn that the Financial Stability Board estimates banks hold globally, but much of the latter is actually invested in bonds — a fact that some US banks have recently rued.

Three decades ago, James Carville, the American political adviser, quipped about wanting to be resurrected as the bond market because “you can intimidate everyone”. Since then, the market has grown fivefold. Tighter regulations on traditional lenders resulting from the recent rash of bank failures in the US will force even more borrowers towards bonds.

The market is now facing one of its biggest tests in generations. Last year, resurgent inflation — the nemesis of financial securities that pay fixed interest rates — triggered the worst setback in at least a century. Overall losses were almost $10tn, shaking UK pension plans and regional banks in the US. And although bonds have regained their footing this year, they are still beset by rising interest rates.

Even if the bond market adapts, as it has in the past, its ballooning power, reach and complexity has some awkward implications for the global economy. “This transformation has been extraordinary, and positive,” says Larry Fink, head of BlackRock, the world’s biggest investment group. “But we have a regulatory system designed for a time when banks were the dominant players. They aren’t any more.”

“Shadow banking” is what some academics call the part of the financial system that resembles, but falls outside traditional banking. Policymakers prefer the less malevolent-sounding — but almost comically obtuse — term “non-bank financial institutions”. At $240tn, this system is now far bigger than its conventional counterpart. The bond market is its main component, taking money from investors who can mostly yank it away at short notice and funnel it into long-term investments.

The question of how to tame shadow banking is one of the thorniest topics in finance today. For the financial system as a whole, it is arguably better that the risks bonds inevitably entail are spread across a vast, decentralised web of international investors, rather than concentrated in a narrow clutch of banks. But in finance, risk is like energy. It cannot be destroyed, only shifted from one place to another. As it gets shunted around, its consequences can morph in little understood, even dangerous ways. We saw a perfect example of this in March 2020, when the Covid-19 pandemic acted as a gigantic stress test for the financial system that revealed fresh cracks in its foundation. But to properly understand the role of the bond market today, you have to go back almost a thousand years to 12th-century Italy.

Doge Vitale II Michiel of Venice was in a pickle. Under a dubious pretext, the Byzantine empire had in 1171 arrested all Venetian merchants in its capital Constantinople and seized their property. But the Italian city-state didn’t have the funds to send a navy to rescue its imprisoned citizens. So the Doge forced all citizens to lend the city some money, in return for 5 per cent interest a year until they were repaid.

The rescue mission did not go well. The Venetian fleet was devastated by plague while negotiating with Constantinople, and the Doge was forced to return humiliated. Back in Venice, irate subjects chased their ruler down the city’s streets and beat him to death. Ruined by the debacle, Venice was unable to repay, turning the emergency prestiti (loan) into a permanent fixture that paid 5 per cent annually.

Most people were eventually fine with this arrangement. The steady interest payments were quite attractive. Occasionally, Venice would raise more prestiti, and the one-time emergency facility gradually became a handy way of raising money. The permanence meant the city didn’t fall foul of the Church’s edicts against usury, ie, loans with unfair terms, so the innovation was quickly adopted by other Italian statelets.

To this day, one of the main differences between loans and bonds is that the cost of the former usually fluctuates — by being pegged, for instance, to a central bank’s interest rate or some other pre-agreed benchmark — while bonds almost always pay a rate that never changes over its lifespan. That’s why “fixed income” is often used as a synonym.

Another crucial difference is that bonds are designed to be traded, while loans are typically not. In 12th-century Venice, prestiti were bought and sold in the city’s Rialto market. Today, bond trading happens by phone, electronic messages and algorithms across the world’s financial centres. This tradability is central to the growth of bonds, as it allows creditors to shift the risk to someone else.

By the 19th century, bond markets had helped shape the world order. Countries that could best finance themselves tended to succeed. England’s victory over Napoleonic France was enabled by its bond market, which allowed it to finance wartime expenditures more effectively than did the local bankers that Paris depended on for short-term, high-interest loans. Meanwhile, the US used bond sales to finance the purchase of Louisiana, crisscross the continent with railways and industrialise its heartlands. “I don’t think a lot of people appreciate the role [the bond market] has played in industrial progress,” says Bill Gross, the co-founder of Pimco, a giant bond investment company. “It has allowed companies and countries to make long-term investments. The combination has been crucial to economic growth.”

The aftermath of the second world war was unkind to the bond market. Although it had provided vital wartime funding for allied governments and remained one of the financial system’s most crucial cogs, accelerating inflation in the 1950s and 60s posed a challenge for securities with fixed interest rates. By the 1970s, buying bonds became a constant, brutal race to stay ahead of inflation’s return-eroding force. The aggressive central bank-rate increases that became necessary to tame runaway prices also lowered the value of bonds issued in a lower-rate environment. People dourly joked that bonds had become “certificates of confiscation”.

But the 1980s brought a new era of slowing inflation, falling rates, regulatory liberalism and financial innovation, which would transform the bond market. “We completely revolutionised how financing was raised, whether it was by companies, homeowners, governments, everything really,” says Fink.

The annual “Predators’ Ball” hosted by the investment bank Drexel Burnham Lambert at the Beverly Hills Hilton became legendary across Wall Street in the 1980s, both for the corporate raiders who gathered there to discuss their latest prey as well as for their debauched behaviour. Michael Milken, who abhorred the limelight, oversaw the affair from the background.

From Drexel’s Beverly Hills outpost, Milken had opened up a whole new frontier for the global fixed income market: high-yield bonds among supporters, or junk bonds according to detractors. He was an unlikely financial revolutionary. In high school, he eschewed the usual sports for cheerleading. When he went prematurely bald, he wore a toupé so ill-fitting that the author Michael Lewis famously said it “looked as if a small mammal had died on his head”. His main hobby was amateur magic tricks. But Milken had brains, ruthlessness and luck.

His intelligence was always clear. At University of California, Berkeley some students reportedly avoided Milken’s classes because he skewed the grading curve. But serendipity also played a part. While studying at Berkeley, Milken had stumbled over a 1958 academic treatise grippingly titled “Corporate Bond Quality and Investor Experience”, by Walter Braddock Hickman.

Hickman showed that while so-called junk bonds (debt issued by companies that failed to secure an “investment-grade” rate from one of the major credit-rating agencies) were indeed risky, they paid such high interest rates that a broad portfolio more than amply compensated investors for the occasional default. Imagine buying a basket of 100 eggs for 50 cents each and selling them for a dollar individually at the market. Sure, they’re fragile and a few might crack on the way, but the price a full egg would collect compared with its cost makes the trade hugely lucrative.

This was a lesson Milken took with him to Drexel. It was a second-tier investment bank when he joined in 1970 but, a decade or so later, it was utterly dominant in the burgeoning junk bond market, thanks to Milken’s careful cultivation (and occasional intimidation) of a vast network of loyal investors who would buy almost anything he brought to them.

There had always been a junk bond market, but it was primarily made up of “fallen angels”. These were once solid companies that had issued bonds when they boasted an investment-grade rating but had subsequently fallen on harder times. Milken transformed this maligned market into a legitimate way to raise money for companies. “To me, it was a form of discrimination — to discriminate against the management and employees of a company which offered value-added products and services, all because it didn’t get a certain rating. It seemed grossly unfair,” he told journalist Connie Bruck in 1987.

No one took to the junk bond market as much as the corporate raiders and private equity tycoons who began to rip through the lumbering conglomerates of the 1980s. The ultimate sign of Milken’s influence became known simply as “the highly confident letter”. Armed with nothing more than a letter from Drexel that stated it was convinced the bank could sell any bonds a company needed, corporate raiders such as Carl Icahn would bid for huge companies before they’d even raised the money. The “highly confident letter” had no legal status, but such was Milken’s power that it was considered almost as good as money in the bank.

The end came as quickly as the rise. In 1990, Milken pleaded guilty to six counts of securities and tax violations. He paid $600mn in fines, agreed to a lifetime ban from the finance industry and served 22 months in jail. Drexel collapsed soon afterwards. (In 2020, president Donald Trump pardoned Milken.)

Nonetheless, Milken’s role in transforming junk bonds from a ramshackle market of ill-repute into a vibrant corner of the financial system — and a viable funding avenue for respectable companies — is indisputable. “Milken and the birth of junk bonds was a big transformation,” says Dalio. “All that corporate borrowing all used to be bank loans and, after Milken, a lot of that became bonds.”

Lewis “Lew” Ranieri was in many respects the polar opposite of Milken. Milken was tall and lanky, came from a middle-class Californian background and had always been obsessed with high finance. Ranieri, by contrast, was a rotund, uncouth, working-class Brooklyn kid, who wanted to be a chef until he discovered that his asthma would make it difficult to work in smoke-filled kitchens.

His first job on Wall Street was working the night shift in Salomon Brothers’ mailroom, which he did to pay for tuition at St John’s University, where he studied English. When he was offered the job of full-time mailroom supervisor, he dropped out. By 1974, he was offered a “front office” job trading the bonds of US utility companies and, in 1979, he began leading Salomon’s mortgage-trading desk. There he assembled a team in his own aggressive image. “He was a bull in a china shop,” Robert Dall, Ranieri’s boss at Salomon for a time, told The New York Times in 2013.

But what made Ranieri’s name was not his persona. Wall Street has had plenty of bombastic bond traders with a penchant for coarse practical jokes. It was what he did to make a dime: packaging up individual mortgages into bonds and then trading chunks of those bonds, a process known as securitisation.

Securitisation is an old concept. Back in 1774, the very first mutual fund bought bonds backed by loans from plantations in the Caribbean and toll roads in Denmark. US mortgage-backed bonds existed as early as the 19th century. But these bonds only used the underlying loans as collateral.

In 1970, the US Government National Mortgage Association (known as Ginnie Mae) engineered the first “passthrough” mortgage-backed securities, where the underlying individual loan payments flowed directly through to the bond investor. This was followed by similar deals by other US mortgage agencies such as Freddie Mac and Fannie Mae, to little fanfare. Ranieri did for securitisation what Milken had done for the junk bond market; he transformed it from the backwaters into a global and massively lucrative industry.

The first fillip was the crisis that struck the US “savings and loans” industry when the Federal Reserve ratcheted up rates in the early 1980s. Congress passed a jammy tax break to make it easier for the banks to shed entire portfolios of mortgages at fire-sale prices. Ranieri’s Salomon was there to scoop them up and flip them to other investors. Money began to course through Salomon’s mortgage trading desk.

Ranieri realised that he needed to turn a one-off vein into an entire gold mine that could be exploited year after year. Luckily, he found some in-house inspiration: an innovative deal his former boss Dall had done with Bank of America in 1977, which sought to tackle the difficulty of valuing the cash flows of mortgage-backed securities with a technique called “tranching”. It sliced them up into different portions each with their own interest rates, maturities and riskiness. That way, each investor could simply choose what kind of exposure they might like — a buffet rather than a set-course meal of variable quality.

Ranieri ran with the idea. Rather than just take the mortgage of one bank, he pooled together bunches of mortgages from lots of them. To handle the complexity, he hired a lot of bright young mathematicians to complement the mini-Ranieris on the trading desk. He then lobbied vociferously for government blessing of the tranching structure, knowing this would add to the products’ lustre with investors. He succeeded. By the mid-1980s, the market took off.

The arrival of personal computers on trading desks was a crucial lubricant, according to BlackRock’s Fink, who ran First Boston’s rival mortgage-backed securities team at the time and worked on a pioneering tranched $1bn Freddie Mac deal in 1983. “Before that, we just had Monroe calculators on our desk, and you had no ability to really understand the cash flow characteristics of various pools of mortgages — for example, the variability between prepayments in California and Oklahoma,” he says.

The story had an unhappy ending: the new market proliferated until it nearly brought the global financial system down in 2008, something that later weighed on Ranieri. “I will never, ever, ever, ever live out that scar that I carry for what happened with something I created,” he told The Wall Street Journal in 2018.

But the fundamental idea — packaging up smaller loans into bigger bonds and thereby bringing together more people who needed money with those who had it — was sound. Done judiciously, it actually makes banks less risky, by shifting the inherent danger of extending loans out of banks and into markets. (This is why securitisation has bounced back since 2008, and is starting to gain ground outside the US as well, often with government encouragement.) “Like everything else, it started off with great intentions. The market just went off kilter from 2004 to 2007,” argues Fink. “It was just a lack of supervision and regulation, and bad behaviour… But the mortgage-backed security market is flourishing again now. Markets become irrationally exuberant, and then correct. We’ve seen that time and time again.”

Siegmund Warburg came from one of Germany’s venerable banking dynasties. In 1934, Warburg, who was Jewish, was forced to emigrate to London, where he set up what would become the merchant bank SG Warburg. His brains, drive and love of 19th-century literature — he was said to hire people purely on the back of a shared love for Anthony Trollope, TS Eliot, Charles Dickens and Thomas Mann — could have helped him settle into the British establishment. But he remained by temperament an outsider.

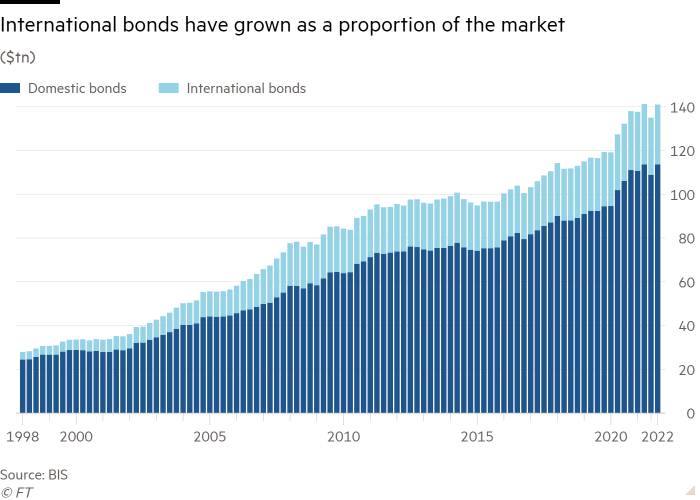

For a City banker of an insular and somnolent era, Warburg was also unusually scrappy and international, with contacts across Europe and the US, and revelled in dealmaking. “It was the human side, in practice the negotiating side, which attracted me to banking,” Warburg once said. All of which was brought to bear on a $15mn bond sale by the Italian motorway company Autostrade in July 1963. This fiendishly convoluted deal marked the birth of the now $30tn “eurobond” bond market.

In truth, “eurobonds” are a bit of a misnomer. They are not necessarily issued in euros, sold by European borrowers or bought by European investors, but merely bonds issued in a currency other than the domestic tender of the borrower. For example, when Japan issues a dollar-denominated bond or Nigeria a Swiss franc-denominated one. These days, they are often more simply referred to as “external bonds”, and they represent the bond market at its most international, stateless and powerful.

Back in the 1960s, European capital markets were balkanised by dozens of different currencies and legal frameworks, so companies and governments went to New York to issue bonds. But there was still plenty of wealth elsewhere that could be funnelled to borrowers, often in US dollar accounts accumulating abroad because of restrictive American legislation. Warburg realised the potential in marrying these “eurodollars” — as the overseas accounts were called, whether they were in Europe or not — with the rising demand for funding around the world.

At the time, the significance of the Autostrade bond sale was little understood. But the birth of the eurobond market proved hugely consequential. It helped restore London as a global financial centre and resurrect a vibrant international bond market for countries and companies alike to raise money.

Although the regulatory landscape that birthed eurobonds has changed radically, it keeps welcoming new debutantes. “We wanted to take the country to the next level,” says Kampeta Sayinzoga, a senior Rwandan treasury official at the time the country sold its first bond in 2013. “Raising $400mn from development banks and donors would have taken three to four years. With bonds, it took five to six weeks.”

Some countries have regretted their dalliance with the bond market, ending up in sovereign bankruptcy. But the tool itself shouldn’t be blamed for occasional mishaps. After all, debt crises have been around far longer than bonds (the first recorded one was when a handful of Greek municipalities defaulted on loans from the Delos Temple of Apollo around the fourth century BC). Nonetheless, the explosive growth of the bond market — and its under-appreciated usurpation of the role traditionally played by banks — has altered the nature of the financial calamities that periodically plague the world.

The texts landing on my phone were becoming more frantic. “This is bad. Liquidity is seizing up everywhere,” one read. “Super sloppy across fixed income today. Treasury market freezing up like we’re trading Zambia,” went another. Bond people are by nature often dour and pessimistic, but they are rarely excitable. The mounting shrillness was unnerving.

It was mid-March 2020 and markets were in meltdown. The Covid-19 pandemic had caused an immediate and severe economic crisis as countries locked down, threatening to spiral into a full-blown global financial calamity. As usual, the TV news focused on the stock market slide, breathlessly detailing every new jagged decline as it happened.

But the real drama was unfolding in the bond market.

Trading had started to seize up earlier in March, as panicky investors yanked billions of dollars from bond funds. They were forced to ditch securities to raise cash in a hurry, but with everyone selling and no one buying, things gummed up. By mid-March, even the mighty and reliable US Treasury market began to creak, and the panic began.

It is hard to overstate the importance of US government debt, or Treasury bonds. Besides its size — at $25tn, this is by far the biggest bond market in the world — the Treasuries market is essential to the functioning of the international financial system. Because of the US dollar’s status as the world’s dominant currency, Treasury yields are what almost everything else is priced off, and they act as collateral for all sorts of other transactions. They are also the bomb shelter of capital markets, the place investors flee to when financial WMDs begin falling. At the peak of the March 2020 market mayhem, the shelter itself seemed about to crumble.

Amid the turmoil, some trading screens with Treasury prices were occasionally going blank — the high-tech equivalent of your stockbroker not picking up their phone during a sell-off. Rumours of cascading hedge-fund collapses ricocheted through finance industry WhatsApp groups. Mark Cabana, an analyst at Bank of America, warned that “large-scale illiquidity” was becoming a “national security issue”, with the US government facing the possibility that it might be unable to finance itself.

Then the Federal Reserve made an extraordinary intervention, promising to buy an unlimited amount of Treasuries. The downward spiral was halted. But the episode showed how the risks of modern finance have quietly but radically evolved. “Yes we bailed out the banks [after the 2008 financial crisis]. But risk has now been transferred to the non-banks in the bond market,” says Gross.

Given how disastrous bank crises can be, it could be a good thing that bonds nowadays are doing more of the heavy lifting. Unlike bank depositors, bond fund investors do not expect to get their money back (even if it can be a shock when things fall apart). And unlike banks, bond funds typically do not use much or even any leverage.

But bond crises can also be painful — as we saw in both 2008 and nearly in 2020. Modern capitalism has largely been ordered around banks as the main intermediaries of money. Central banks were mostly set up to backstop these commercial banks, and, eventually, they began trying to regulate the temperature of economies by tweaking the cost of their funding, moving overnight interest rates up and down. But with the rise of bond markets, entirely new challenges have emerged and experimental tools to deal with them have become necessary — most notably quantitative easing, negative interest rates and “yield curve control”.

If the ultimate goal is to regulate the temperature of an economy by changing the cost of credit, then the fact that credit is increasingly extended by the bond market rather than banks inevitably has consequences. The market’s decentralised nature means that dangers can be harder to monitor and address, requiring massive, untargeted “spray-and-pray” monetary responses by central banks when trouble erupts.

Unfortunately, the custodians of the financial system have yet to fully grapple with those consequences, even if everyone from the Federal Reserve to the IMF has repeatedly warned about the multi-faceted dangers the shift from banks to bonds entails. As BlackRock’s Fink argues. “Historically, bank regulators — whether they do a good or bad job — understand macroprudential risk a lot more than security regulators. But security regulators are now responsible for more of the economy than bank regulators,” he warns. “There are some gaps now.”

If the global economy is a machine, and credit its fuel, then banks and the bond market are its twin engines. After the disaster of 2008 we scrambled to fix and reinforce the breakdown-prone banking system. But we have done little to nothing when it comes to the bond market. That could turn out to be a bigger problem than anyone wants to admit.

The article has been amended since publication to correct the name of University of California, Berkeley

Robin Wigglesworth is editor of FT Alphaville

Follow @FTMag on Twitter to find out about our latest stories first

Comments